san francisco sales tax rate history

Anaheim 7750 Orange Anderson 7750. The 200 percent local tax rate cap is exceeded in any city with a combined sales tax rate in excess of 925 725 statewide tax rate plus the 200 tax rate cap.

States With Highest And Lowest Sales Tax Rates

As of April 1 2022 the following 140 California local jurisdictions have a combined sales tax rate in excess of the 200 percent local tax rate cap.

. The California sales tax rate is currently. California has recent rate changes Thu Jul 01 2021. What is the sales tax rate in San Francisco California.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. 2018 - hotel room tax rate history san franciscos hotel room tax rate is on the upper end of the tax rate spectrum san jose 894 943 10 00 san leandro 10 00california sales tax rate changes april 2015 avalara. This scorecard presents timely information on economy-wide employment indicators real estate and tourism.

Scroll below to view historical statewide sales tax propositions. Angels Camp 7250 Calaveras. City of South San Francisco Sales Tax Measure W November 2015 San Mateo County.

San Jose Sales Tax Rate History Sales And Use Tax Software Demo Vertex Cloud. Please ensure the address information you input is the address you intended. 4 rows The current total local sales tax rate in San Francisco CA is 8625.

With local taxes the total sales tax rate is between 7250 and 10750. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar. 5 new Below Market Rate homes for sale 2238 Market St.

The minimum combined 2022 sales tax rate for San Francisco California is. City Rate County American Canyon 7750. San Jose Demographics And Diversity San Jose.

California CA Sales Tax Rates by City A The state sales tax rate in California is 7250. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. Download all California sales tax rates by zip code.

Some cities and local governments in San Francisco County collect additional local sales taxes which can be as high as 3625. 2 studios 1 1-bed 2 2-bed homes priced from 292897- 402447 wo parking and 324964-448880 w parking. Select the California city from the list of cities starting with A below to see its current sales tax rate.

About This Home. 100 of Area Median Income 2021 1 person-93250. California has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 35.

Presidio of Monterey Monterey 9250. Historical Tax Rates in California Cities Counties. Next to city indicates incorporated city City.

The tax rate given here will reflect the current rate of tax for the address that you enter. Applicants must be first-time homebuyers cannot exceed the following income levels. California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 1 P a g e Note.

You can print a 9875 sales tax table here. San Francisco Tourism Improvement District. Presidio San Francisco 8625.

The December 2020. Average Sales Tax With Local. 5 digit Zip Code is required.

Concord 875 San Mateo County TBA 050 November 2018 ballot San Diego 775 Daly City 875 Denver 765 Redwood City 875 Miami 700 San Francisco 850 Boston 625 Walnut Creek 825 Washington DC 575 SourceNotes CURRENT Bay Area Sales Tax Rates and 2017 Sales Tax Ballot Measures1 ProposedEnacted Changes in Sales Tax Change in Sales Tax. Type an address above and click Search to find the sales and use tax rate for that location. The San Francisco County Sales Tax is 025.

For tax rates in other cities see. Proposition 172 1993 extended the state sales tax rate of 6 percent. This is the total of state county and city sales tax rates.

There are a total of 474 local tax jurisdictions across the state collecting an average local tax of 2617. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc Agoura 9500 Los Angeles Agoura Hills 9500 Los Angeles. The San Francisco County California.

The San Francisco Tourism Improvement District sales tax has been. There have been 72 local sales tax rate changes in California. Rate County Acampo.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. California first imposed a sales tax of 25 percent in 1933. A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California sales tax.

Proposition N passed in November 2010 created a new tax rate of 25 for transactions greater than or equal to 10 million and increased the tax rate on transactions of 5 million to 10 million from 15 to 20. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. The San Francisco sales tax rate is.

To view a history of the statewide sales and use tax rate please go to the History of Statewide Sales Use Tax Rates page. These transactions had previously been taxed at the 075 rate. The County sales tax rate is.

The Bradley-Burns Uniform Local Sales and Use Tax Law was. Did South Dakota v. It has changed 19 times since then according to the California Department of Tax and Fee Administration.

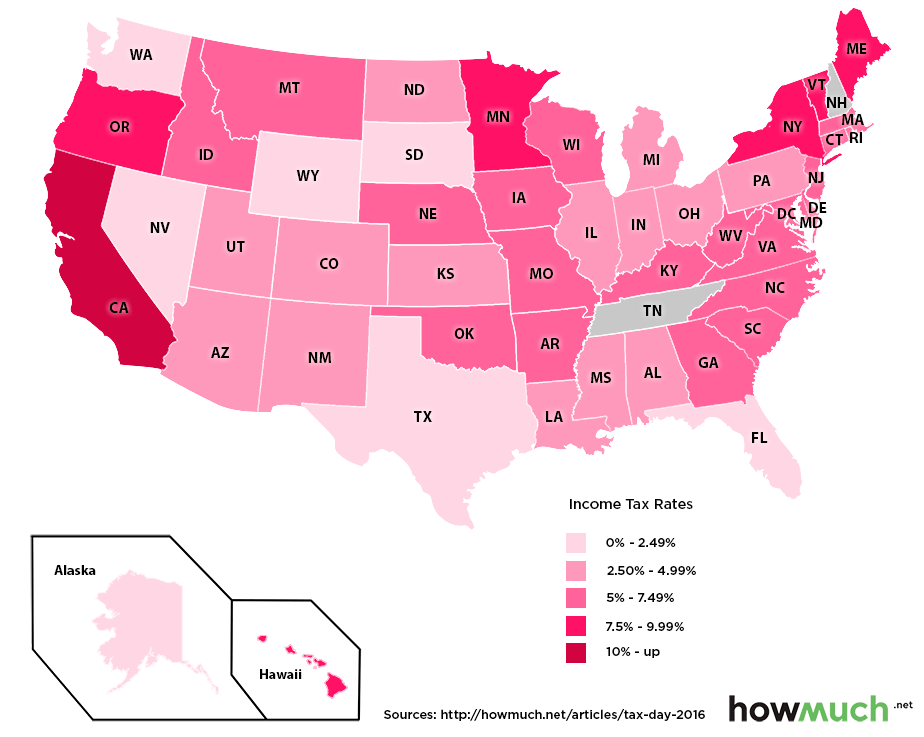

Which U S States Have The Lowest Income Taxes

Sales Tax Collections City Performance Scorecards

How Do State And Local Sales Taxes Work Tax Policy Center

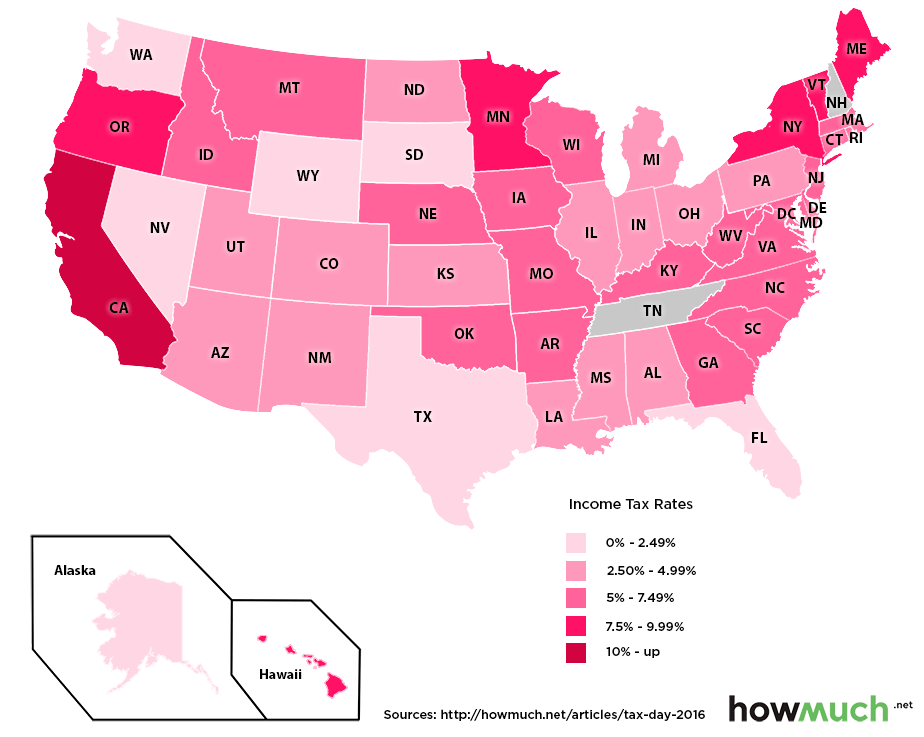

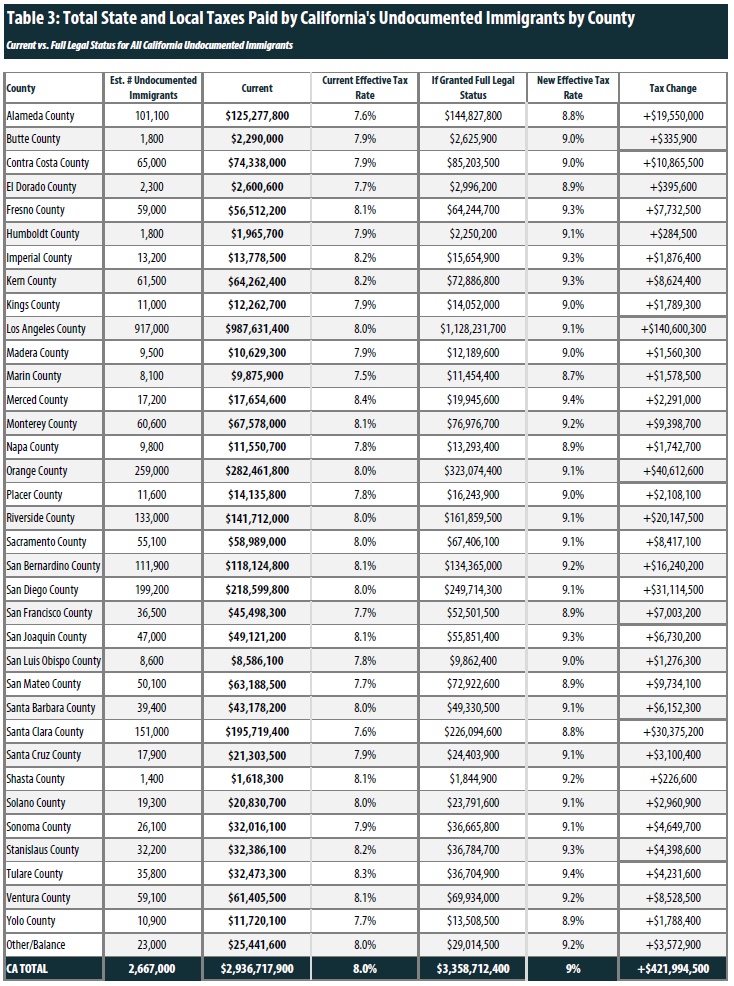

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

Frequently Asked Questions City Of Redwood City

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Rates In Major Cities Tax Data Tax Foundation

State And Local Tax Contributions Of Undocumented Californians County By County Data Itep

Do States Like New York And California Really Have High Taxes Quora

States With Highest And Lowest Sales Tax Rates

Property Tax History Of Values Rates And Inflation Interactive Data Graphic Washington Department Of Revenue

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)